Introduction

Foreign Direct Investment is related to investment made by the firm or an individual in the interested business which is located in another country. It generally takes place when an investor plans to take part in foreign business operations or acquires any foreign business assets. It can be inclusive of ownership establishment or related to controlling interest in some foreign company. FDI can be pivotal in a company's growth strategy, thereby helping the country to grow and enhance its economic standing. (Lee, 2013).

The aim of this report in Section 1 is to provide a comprehensive understanding through various empirical studies about the importance of FDI and its roles in progressing different economies worldwide and also elaborates on the factors affecting FDI, particularly focusing on sovereign credit rating in developed and developing countries in general. Additionally, the report focuses on Germany's economy and illustrates the crucial factors attracting FDI inflow in Germany including political and economic stability, sovereign credit rating, market size, and so forth. Section 2 analyses the economic situation of Germany statistically in terms of FDI inflow, GDP, market size, and risk rating extracted from the risk rating agencies. In Section 3 the report evaluates the current and future economic situation of Germany. Eventually, the report sums up all the findings and conclusions retrieved from the analysis and literature review.

Need to Consult Directly With Our Experts?

Contact UsLITERATURE REVIEW

2.1 The Importance of FDI and Its Impacts on Different Economies

According to Moran, (2012), a strong relationship has been assessed on foreign direct investment and economic growth. A large inflow of investment is generally required by countries, so as to achieve a sustainable high trajectory of economic growth. Foreign investments and borrowings help in bridging the gap between investments and savings. FDI is considered a powerful engine that enables low-income countries to build physical capital, generate employment opportunities, enhance the skills of their laborers, and increase productive capacity and managerial competency. Moreover, FDI also contributes to integrating domestic economies with global ones. (Morgan, 2012). However, in contrast to this, as per the views of Alfaro and Johnson, (2012) a considerable change in flows of trade and finance has been noticed due to an extensive surge in FDI. There are various underlying factors that are directly contributing to increasing the flows of FDI in Bangladesh. Those factors are trade exchange liberalization, appropriate emphasis on development led by private sectors, and opening and enhancing of infrastructural services. The most important factor which led to increasing the FDI in the country is the privilege of the advanced energy and telecommunication sectors and thus, in turn, foreign investors will benefit. Myanmar has also become a new destination for multinational companies, due to its stable economic growth and its ability to deliver higher rates of interest to foreign investors. (Alfaro and Johnson, 2012).

According to Ramasamy, Yeung, and Laforet, (2012) FDI acts as a supplement to Australia's national savings, develops infrastructure, supports local businesses, and also helps in building its regional economies. (Yeung, et al., 2012).

Figure 1: Foreign Direct Investment in Australian economy

(Source from: Impact of Foreign Direct Investment on Gross Domestic Product, 2011)

As per Blonigen and Piger, (2014) FDI can be categorized as being horizontal, vertical, and conglomerate. A horizontal direct investment is related to the investment made by a company in the same type as it operates in its home country. For instance, a mobile phone provider, currently operating in the United States, planning to open up new stores in China. (Blonigen and Piger, 2014). Jadhav, (2012) defined a vertical investment as one that is related to investment made in some different organization, but related companies, from that of the investor's main business, so as to acquire some foreign company for its smooth operations. For instance, a manufacturing concern acquires the interest of some other foreign company that is involved in supplying raw materials required to its main businesses. A conglomerate type of FDI is one when a company plans to invest in some other organization that is totally unrelated to the existing one in the home country. (Jadhav, 2012).

Get expert btec assignment writing service from our professional writers today!

2.2 Factors Attracting FDI

According to Fernandes and Paunov, (2012), there are various factors that can tremendously affect the flows of FDI positively or negatively. Investors are driven to go for FDI in order to access cheap raw materials, natural resources, communication and transport links, wages and skills related to labor, availability of strong infrastructure, new customer base, and potential and bigger market sizes. On the other hand, political instability can negatively affect the FDI aspects of any country. Exchange rate measures have to be taken into consideration by multinational firms in order to go for FDI, due to their huge impacts on the business transactions of those firms, whereby any company operates in any foreign country, has to use the local currency of that foreign country, which, in turn, will result in appreciation of that local currency, and if the volatility of the foreign currency is not high, this will help companies to reduce their costs and achieve economies of scale. Hence, it can be stated that a preferable flow of these factors can lead to a positive impact on its functioning. However, factors questioning the existence of the company can act as a negatively affecting factor of FDI. In contrast to this, as per the views of Buchanan Le and Rishi, (2012) investment criteria may differ based on the opportunity cost available in some other countries. For instance, if a multinational company finds that it will be able to generate higher profits by investing in China rather than the US, then, despite having favorable conditions later, it will invest in the latter one. (Buchanan, et al., 2012).

2.3 Effect of Sovereign Credit Rating on FDI

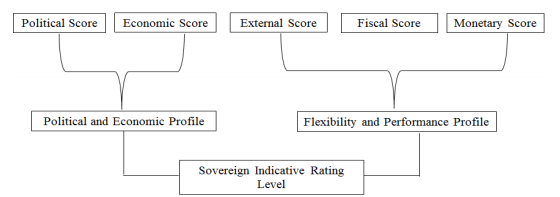

According to Kasemsap, (2017), Sovereign credit rating is an evaluation that is performed by credit rating agencies based on the future abilities and willingness of sovereign governments with respect to their fulfillment of debts. There are approximately 150 national, regional, and global credit rating agencies that are involved in addressing the competencies of companies based on various factors. The stars are given to the companies on five major factors. These are economic scores reflecting economic structure, political risks, external liquidity, international investment position, debt burden, and monetary flexibility of the company.

Figure 2: Factors Affecting Rating

(Source: Impact of Foreign Direct Investment on Gross Domestic Product, 2011)

However, in contrast to this, as per the views of Alfaro and Charlton, (2013) based upon the financial stability of the company, the creditworthiness of the organization is determined. It ultimately helps in making decisions about whether to invest in the organization as FDI or not.

2.4 FDI in Developed Countries and Germany

As per Lau, Choong, and Eng, (2014) FDI in developed countries is operatively higher than in developing countries, due to many reasons, such as the availability of technology, skilled workforce, and government support. Moreover, the possibility of growth in developed countries is rather higher in comparison to developing and underdeveloped ones. It also helps in assuring constant economic growth indicating positive results through the investment. Germany has been able to become dominant in foreign direct investment flow compared to other European countries in 2014, due to its outrageous increase in its revenues which are enhancing its ability to invest for FDI. However, in contrast to this, as per the views of Holmes Jr. et al., (2013) the United States and Japan have currently been experiencing outward FDI. They are being able to create themselves as an avenue to deliver knowledge-intensive services. The growing investment income from the outward flow of FDI has been able to counterbalance the trade deficit.

2.5 European Union and Other Treaties Made to Attract FDI and Trade

European Union has been able to become the largest source of Foreign Direct Investment as per the global economy. International investments in the EU are worth €5.4 trillion which is equivalent to approximately 36% of the total wealth produced by the EU. FDI has been able to provide 7.6 million jobs in the EU. It also provides capital and technology in order to foster European research, competition, and innovation. EU investing abroad is worth €6.9 trillion which is 46% of the annual wealth produced by the EU supporting 7.6 million jobs in the EU. It also helps in optimizing production, and adequate access to raw materials and other components which can help in serving the market in a better format. However, in contrast to this, as per the views of Chandran and Tang, (2013) the main aim of the EU so as to promote FDI is to open up foreign markets for EU companies. It has also been able to make investment rules clear and concise so that they can effectively be followed by the organizations functioning in EU territories. (Sbia, et al., 2014).

3.0 Analysis

FDI Flow of Germany

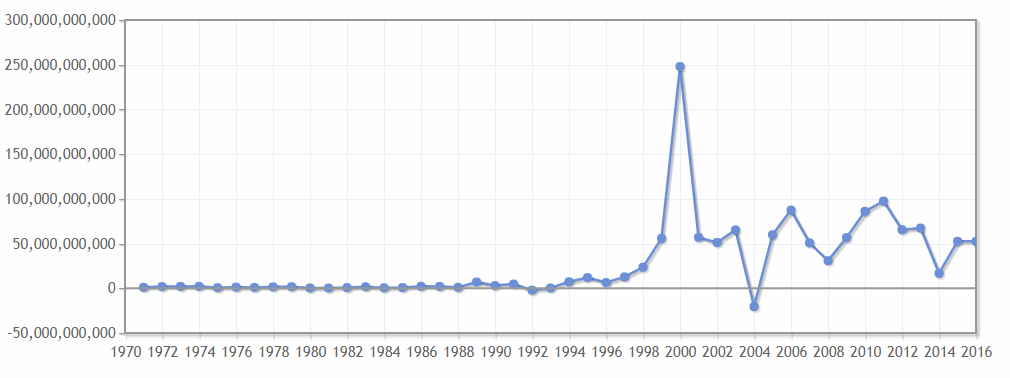

Figure 3: FDI Inflow of Germany

(Source from Germany Foreign Direct Investment, 2017)

Figure 3 reveals the FDI inflows of Germany from the period of 1970 to 2016. In 1990 there was an upward trend of the FDI inflow in Germany, due to the European Union. In 2000 the FDI inflow of Germany surged dramatically to nearly 250 billion Euros due to the.. The FDI net Inflow in Germany is $52,474,200,000 as of the year 2016. The value has been constantly fluctuating since the year 2004. In the years 2008 and 2009, the value of FDI decreased to a great extent due to the prevalence of the economic crisis that took place in the US. Its impact was borne by the inflow and outflow of FDI in all the European Union countries, inclusive of Germany. Comparing the graph with the value of FDI in the years 2017 and 2018, it can be assessed that the values have increased tremendously indicating FDI inflow growth in the country. The main financial motive of FDI is to ensure the strategic movement of currencies from the home country to the host country. Germany has been able to represent itself as a unique location with utmost consistency. The first essential industrial characteristic of the German market is related to the presence of a large number of SMEs that have been able to become financially famous in both domestic as well as international market. The second important aspect related to the presence of FDI in Germany is the big and successful companies that have been able to get themselves renowned at the global level. Some of the automobile companies include Bayer, BMW, and Volkswagen. There are various chemical-related companies as well, such as Soda Fabrik, Baddische Annilin, and Hoechst. They have effective managerial structures that have been able to achieve economies of scope and scale (L

Company

Company