INTRODUCTION

Management accounting is refers to as system of planning , recording, controlling the financial resources in an organisation. Objective of this accounting system is to help business entity in controlling the cash flows. It allows manager to record all financial transaction which can be used for estimating the costs or expenses which are to be incurred when executing specific activity. Managerial accounting is also defined as procedures of making essential data available to company managers who directly responsible for a firm's operations. This accounting system assist manager in making suitable decisions related to an organisation. Managerial or management accounting includes the integration of both financial and non-Monetary statements .It intends to provide useful information to the management so that the management can take effective decision for the business. This accounting system plays significant role in delivering information about the financial position of the company to both internal and external stakeholders.

The present report have focus on developing the understanding about the concepts as well as importance of management accounting in an organisation. It has focus on identifying different methods used for management accounting reporting.

TASK 1

P 1 Explaining management accounting

Management account is defined as process of recognising, evaluating, analysing, interpreting as well as communicating the financial target of company. This accounting system also includes recording of financial transactions in systematic format. The financial transaction are recorded with the purpose of identifying the amount of income earned and expenses made by an organisation during particular financial year. Management accounting is considered to be as an effective system which helps manager in making suitable decision-making accounting records both financial and non monetary transactions which provides management an ease in making suitable judgement. It supports manager in formulation of appropriate strategies, plans and policies for an enterprise. Purpose of management accounting is to help stakeholders analysing the financial performance of company in the market. This accounting decision supports investors in making decision related to the further investment in the future. The main aim of management accounting system is to assist business entity in improving financial performance. Management accounts also supports manager in ensuring effective as well as efficient utilisation of funds. Budgeting procedure is followed by manager in RYANAIR for managing liquidity of funds. This technique have assisted an organisation in controlling the cost and managing the cash transactions. Management accounting system also helps manager in making appropriate financial plan for business.

There are several types of management system which can be used by RYANAIR for managing funds. These accounting system has varieties of uses-

Cost accounting system- It is considered to be as the most effective as well as useful management accounting system In terms of determination of cost of goods. Cost accounting system helps manager in setting the price for product or services. By utilising this accounting system manager in an enterprise estimates cost which incurred in producing specific products , then on the basis of total expenses profit margin is decided.

Cost accounting system is beneficial as well as useful in companies which has several functional units. This accounting system can be implemented by RYANAIR company as this will assist help manager in estimating or evaluating the cost which has been incurred by firm on producing specific goods. It is very much essential for manager in RYANAIR enterprise to ensure defectiveness of accounting system.

Inventory management system- This type of accounting system are generally utilised for managing inventory. If Inventory management system implemented by RYANAIR enterprise, it will help business entity in increasing working efficiency. This management system supports manager in ensuring effective utilisation of resources. The manager in RYANAIR should design replenishing strategy. As this activity will assist planning of cost requirement by operations in advance. This system is considered to be effective as it helps an organisation in reducing the cost of storing as well as managing inventory.

Job costing system-It includes assigning of manufacturing cost to each and every task in order to keep record of expenses. This management accounting system can be used by RYANAIR enterprise, for manufacturing of identical goods. Job costing procedure include :

Receiving enquiry-In present world customers are much concerned about quality of raw material utilized for producing the goods, price of product and time taken by workers in an organisation for processing the order.

Price Estimation- The price is ascertained by manager by considering the different constituents such as product quality , value or satisfaction gained by consumer, need and preference of people in society , demand for specific or supply of specific good.

Order receiving- order is ordered by customer when a person is satisfied with the price of goods as well as they are assured about product quality.

Production order- This order is placed at the first phase of process of production.

Recording of cost-It is needed by manager in an operational department to record several aspects of cost involves in producing product.

Completion of task- After completion of task,it is essential for production manager to submit report to account department. It is responsibility of account manager to compare actual cost with standard and identify the gap.

Price optimising system- It is considered to be as an effective system which is generally used for ascertaining the price of different products at same time. It assists manager in analysing the variation in demand of specific good at various level of prices or changes in cost of specific product (Butt, 2010)

P 2 Different methods utilised for management accounting reporting

The management accounting system is considered to be effective in terms that it assists manager in creation of financial plan for business. Manager in an organisation should concentrate on managing quality of reports and information in document. As this activity will support user in believing or ensuring reliability of the information restrained in the report. The various form of reports which are prepared by management as well as finance department in an organization department and its benefits are:

Budgeting report: It is considered to be as an important document, which assists manager in making the financial plan which is prepared on the foundation of analyses on an organisational performance. Budget reports provides the detail about the amount of financial resource which could be used by the particular functional unit. This types of reports are created with purpose of controlling expenses . Budget report assists functional unit in improving their performance. It also provides manager an opportunity to make several calculations and analyse the scope of providing incentives to workers for their good performance within an enterprise. Preparation of budget help business entity in integrating the efforts of various administrative division in order to drive firm towards achievement of set target.

Job cost reports: It includes the detail information about the cost or expenses incurred as well as profit earned by an enterprise during particular financial year. Job cost reports assist management in identifying the most important as well as profitable activities. It also business entity in eliminating unnecessary operations which are adding cost to company.

Performance reports: this report includes the information about

Inventory as well as manufacturing report:This reports consists of estimation about the several expenses such as overhead expenses, fixed as well as variable cost , wastage, cost of labour etc. Inventory and manufacturing report help manager in formulation of appropriate strategies or plan which used for minimising wastage and eliminating additional cost.

Order information report : This report is considered to be very useful, as it helps management in identifying or analysing the demand for specific products or services. Order information report enables manager to make appropriate decision related to development of products.

business Opportunity report-It assists manager in identifying as well as capturing several opportunities for company. This reports help manager in integrating various business procedures, system and operation (Ahrendsen and Katchova, 2012)

TASK 2

P3 Calculating costs per unit under both absorption costing and marginal costing

The cost , refers to the amount of money or funds used by an Enterprise for producing or manufacturing goods or services. This factors also includes quantitative computation of stock, raw material , stock , risk , time , opportunities which has been availed or an enterprise has fail to achieve in context of production process. There are different types of expenses can be incurred be firm in manufacturing goods, for instance,

Variable and Fixed costs: Expenses which remains constant during the production procedure is considered to be as fixed. The cost which fluctuates with the increase or decrease in level of production is recognised as variable expenses.

Replacement and Historical cost- The cost which are incurred by an organisation during previous financial year in producing the specific product is known as Historical expenses. Replacement cost are considered to be as an expense which are to paid by company for replacing the products.

Avoidable and Unavoidable cost- expenses which can be reduced through proper financial planning are considered to be as Avoidable. Unavoidable cost are uncontrollable in nature.

Sunk cost- This types of cost are recognised as additional expenses which has to be incurred by an enterprise due to the continuous changes in system , business operations as well as activities. Sunk costs are computed by evaluating the cost incurred in producing or manufacturing additional unit of products. Incremental cost represents the

Average, Total and marginal costs- Gross expenditure include all the cost that is incurred by an organisation during production of goods. Marginal costing includes the additional expenses incurred by business entity in producing the extra unit of item. Average expenditure includes the cost incurred by firm in producing an individual unit.

opportunity and Outlay cost- Opportunities cost is represents the expenses in terms of profit or revenue that is foregone for selecting another suitable alternative. Outlay cost represents the actual expenditure incurred by an enterprise for making purchase of machinery as well as employing technology in a company. This form of cost thought is applicable for making crucial judgement related to business such as capital budgeting decisions (Brook, 2012)

Interpretation- From the above info it has been analysed that there is difference between net operating income or profit.The major reason for the difference is the use of method which has been applied for computing the costs as well as profits. The two methods of calculating expenditure are absorption as well as marginal costing. In prior method, absorption costing all the disbursement are separates and then are deducted from sales. Therefore, it leads to increase of cost and thus it lowers the profits. In marginal costing expenditure are deducted into two segments these are fixed and variable. It has been also identified that RYANAIR company has adopted the RYAN ECONOMEAL ” sale , this strategy has helped an organisation in attracting number customers. Manager in an enterprise need to take appropriate actions for minimising the cost or expenses (Anessi-Pessina, Barbera,Sicilia and Steccolini, 2016)

TASK 3

P 4 Advantages as well as disadvantages of different planning tool utilise for budgetary control

Budget is considered to be as formal statement which consists of determination of income as well as expenses which could be incurred by firm during specific financial year. It includes the forecast of percentage of profits which will be earned by an organisation .All the estimates made by the finance manager when preparing the budget is based on the analysis of financial performance of company. Budget includes the fiscal plan which consists of description about the way an enterprise will arrange funds for fulfilling the needs of business. Purpose of preparing the budget is to sup[port manager in identifying the techniques or appropriate strategies for reducing the costs and helping in recognizing the sources from where the financial resources can be obtain during the time of emergencies.

The Different planning tools are :

SCORO- This planning tool provides manager in RYANAIR enterprise with various budgeting techniques. SCORO is considered to be as effective tool for making financial plan. It can also be used for managing as well as controlling budgets. It is combine budgeting process with customer relationship management. This planning tool helps manager in arranging as well as storing financial information at one place, so that data can be easily retrieved at the time of requirement.

PROPHIX- It helps RYANAIR company in identifying the goods that scales as well as developed constantly with the growth of an enterprise. PROPHIX is considered to be adaptable, flexible as well as an effective tool which can be utilised by manager in an organisation for preparing various types of budgets. It also assists manager in ensuring the system allocation as well as distribution of resources. PROPHIX supports firm in increasing working efficiency.

There are several types of budget , these are:

Capital budget- This financial statement includes detail description about the receipts and payment. Capital budget is generally used by manager in an organisation for allocating funds. It is considered to be as an appropriate tools in terms of managing fixed assets of business. Purpose of capital budget is to aid an enterprise in controlling the expenses of big amount which has great as well as significant effect on the long term decision and financial plan.

Operating budget-This form of budget is mainly include the projection or forecasting of anticipated income, disbursement and expectable cost for particular financial year. In context of RYANAIR enterprise, operational budget is mainly prepared for monitoring as well as controlling production activities. This type of budget assist business entity in enhancing routine business function. It also helps firm in improving productivity and increasing working efficiency.

Disadvantages of budgets

Interdepartmental conflict- Inflexible budget some times lead to the Interdepartmental conflict which generally takes place due to lack of sufficient amount of resources.

Budgetary slack- This types of performance gap generally take place when there is high level of fluctuation in proposed receipts or expenditures. It occurs in case when manager in an enterprise under or overestimate the cost or receipts in order to gain the benefits or obtain the funds for facilitating different operations in an organisation.

Increase in pressure- Strict or fixed budget can lead to the compromise in quality of products or services. It increases the pressure on the project manager as well as employees. Inflexible budget can create various barriers in completing the task (Alino and Schneider, 2012)

TASK 4

P 5 Comparing financial performance of RYANAIR with one of the twoEasy Jet

There are some accounting techniques which can be used by manager in RYANAIR company which help business entity in recognising financial issues. It will help an organisation in developing the understanding about the constituents which have counter consequence on the performance of an enterprise. It also assists manager in analysing the methods, plans , strategies which can be implemented for improving financial condition. Utilisation of budgetary control techniques in planning as well also in executing of several activities in RYANAIR will has helped business entity in maintaining their concentration on the achievement of set targets or standards.

Some indicators for measuring the financial performance of an enterprise include:

Profitability ratio-It indicates the portion of sales which the company has departed in order to pay operational cost for earning profits.

Liquidity , debt and solvency ratio:It represents an organisation ability to make payment of short term debt that has been taken by business entity catering the need of business.

Revenue ratios --It help manager as well as other stakeholder in computing the income generated from sale of trade good or services.

Qualitative Performance indicators are :

Quality of goods:It has direct impact on the sustainability of a company in the market.

Human resource management :It helps an organisation in finding the methods or techniques adopted by human resource management team for retaining talented workers for long time. This indicator shows the percentage of worker turnover during specific year.

There are several strategies which are adopted by management team in RYANAIR company for responding to financial issuers includes :

- Manager in RYANAIR enterprise has created few policies as well as implemented few regulation which are aligned to business objectives.

- Management team in RYANAIR company has use different tools and techniques for assisting an organisation in making appropriate decision related to sustainable matters.

- Manager in an organisation with the support of employees has successfully employed management accounting system which has helped firm in dealing with financial problems (Grimm and Blazovich, 2016)

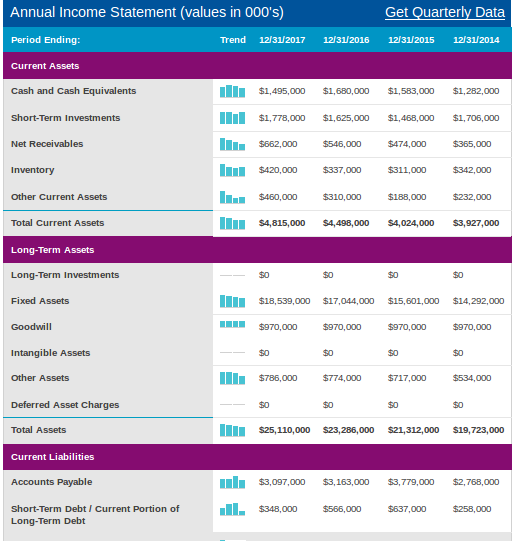

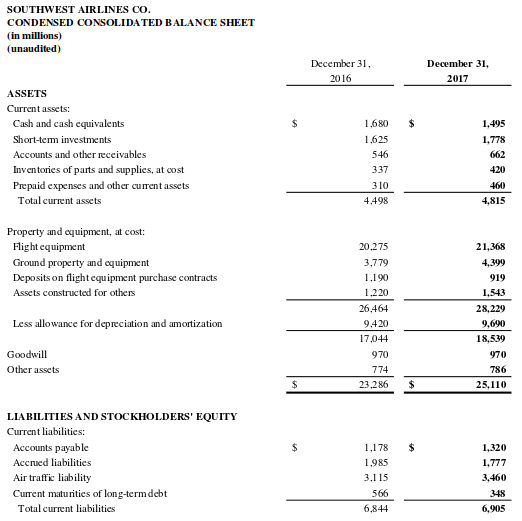

Comparison of Financial performance of RYANAIR enterprise with

Financial data of RYANAIR enterprise

Financial information on south west Airline

CONCLUSION

Project has concluded that management accounts has important role to play in helping an organisation in improving financial performance and reducing the expenses. Study has successfully explained the concept of management accounting and has demonstrated the importance of same. It has been concluded from the assignment that management as well as cost accounting when integrated together can help business entity in elimination several financial issues. Management accounting is considered to be as effective system which helps manager in managing the cash flows and financial transactions. Study has also highlighted the advantages as well as disadvantages of budget. It has been also concluded from the project that . Proper utilisation as well as application of management tools and techniques offers different strategies and plans.

There are various strategies as well as techniques has been suggested which can be used by an organisation for providing suitable response to financial performance.

REFERENCES

- Butt, M. 2010, "Variance analysis",Accounting, Auditing & Accountability Journal. vol. 23, no. 6. pp. 816-816.

- Ahrendsen, B.L. and Katchova, A.L. 2012, "Financial ratio analysis using ARMS data",Agricultural Finance Review,vol. 72. no. 2. pp. 262-272.

- Brook, D.A. 2012, "Budgeting for national security: a whole of government perspective",Journal of Public Budgeting, Accounting & Financial Management. vol. 24, no. 1. pp. 32.

- Anessi-Pessina, E., Barbera, C., Sicilia, M. and Steccolini, I. 2016, "Public sector budgeting: a European review of accounting and public management journals", Accounting, Auditing & Accountability Journal.vol. 29. no. 3. pp. 491-519.

- Alino, N.U. and Schneider, G.P. 2012, "Conflict reduction in organization design: budgeting and accounting control systems",Academy of Strategic Management Journal. vol. 11, no. 1. pp. 1.

- Grimm, S.D. and Blazovich, J.L. 2016, "Developing student competencies: An integrated approach to a financial statement analysis project",Journal of Accounting Education. vol. 35. pp. 69.

Company

Company