Introduction

In the UK, tax is a major source of income for the government. Taxes are collected on income, products, and services by the government. Tax income of the government is classified as direct and indirect. Direct tax includes tax on income, capital gain, inheritance tax, and corporation tax, while indirect tax includes excise duties, value-added tax, stamp duty, etc. HMRC (HM Revenue and Customs) is the regulatory body responsible for tax collection in the UK and provides an online platform for the computation and payment of tax (Braithwaite, 2017). This report provides a brief discussion on the concept of the tax gap, tax avoidance, tax evasion, arrangements used by tax payers, and relevant steps taken by the government and HMRC.

TASK

1. Tax Gap:

The term tax gap refers to the amount of difference that arises between income generated by the government through various tax revenues under the tax system and the amount of tax actually received by the government. This amount of tax gap is expressed by a tax reduction system or optimisation arrangements. However, practically, it is difficult to determine a fixed or certain interval of the tax gap. Such a gap is a result of tax avoidance and tax evasion, and countries across the world are dealing with this issue (Khwaja and Iyer, 2014). For example, in the UK, the aggregate tax gap during the 10 years from 2007 to 2017 was approximately £325 billion.

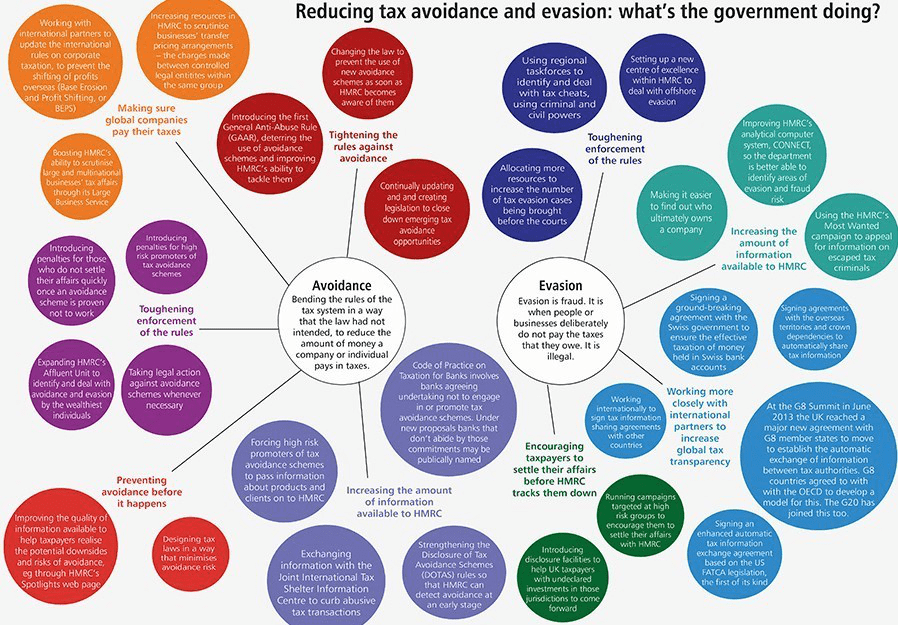

2. Explanation about “Tax Avoidance” and “Tax Evasion” and persistent and aggressive Tax Avoidance Schemes or Arrangements:

- Tax avoidance: It simply refers to the application of various legal ways or methods to make arrangements in the income of any taxpayer to reduce or minimise the amount of tax on income. The arrangements used by taxpayers under avoidance are inspired by legal practices or loopholes in tax regulations. Using various deductions to reduce tax expenses, applying tax credits like work opportunity tax credits, formulating a tax deferral plan under the scheme of the government, etc. are some major examples of tax avoidance.

- Tax Evasion: It looks like tax avoidance, but in tax evasion, illegal methods or ways are used by tax payers to intentionally avoid or evade sources of income to reduce the amount of tax actually payable. It is considered an offence under the tax system, and penalties are prescribed in acts and regulations to prevent such acts. Producing incorrect or false information to tax regulators about the source of income and business, paying tax below the amount payable intentionally, etc. are examples of tax evasion.

- Persistent and aggressive Tax avoidance scheme: There are several tax avoidance and tax evasion schemes that HM Revenue and Customs (HMRC) started to crack when a large number of cases involving some well-known personalities came into the picture, which they called the K2 scheme. This scheme involved companies that opened off-shore branches. In this scheme, the employee resigns from his job and, after some time, gets rehired by these offshore branches, which basically have no assets or operations, for a lesser salary. Then the company gives the employee a huge amount on loan, which reduces the amount of tax payable. The second scheme that the companies use to avoid tax is VAT supply splitting. In this scheme, the customer splits their single order into different small orders, which results in a lower VAT rate applied to each order (Rogoff, 2017). The HMRC considers it to be a tax avoidance scheme that is technically legal. The most commonly used way to get a tax benefit is by opening an offshore account. The European Parliament has implemented the fourth legislation, which will require all multi-national companies to report their financial data from the various countries in which such companies are operating. This scheme of tax avoidance came when a document was leaked in 2016 that contained the report and financial details of approximately 200,000 offshore accounts known as Panama Papers. Individuals, in order to avoid tax, make arrangements by using deductions like the tax bracket for married couples, personal allowances like marriage allowances, and other tax reliefs. Also, individuals make manipulative disclosures to obtain additional deductions and tax relief.

(Source: What's the government doing to reduce tax avoidance and evasion? Infographic, 2013)

3. Measures Adopted by the Government to Minimise Tax Avoidance:

During the past year, the UK's government has taken several steps to avoid or minimise tax evasion and avoidance. In a series of these steps, the government has outlined approximately 21 measures to reduce tax abuse. In the UK, the tax gap has been reduced to 5.7% in 2016-17, which is the lowest in five years and is considered a remarkable achievement, although there are improvements required. Beside this, the government and HMRC are planning to raise £240 million in VAT tax by tightening and imposing strict regulations in the VAT collection system. They have also issued notifications and circulars regarding the imposition of a higher penalty on late deposits and the avoidance of tax. But sometimes these steps hurt the sentiments of small traders, so the government should determine grades to bifurcate penalties. The UK government makes amendments to laws to stop the use of new arrangements of tax avoidance as per reports provided by HMRC. It also makes initiations to investigate more into large businesses for this government, continuously expanding the powers of HMRC to identify and deal with such affairs. The government is going to sign an important contract with the Swiss government to ensure that deposited income in the Swiss bank is not black money. The government is promoting tax payers to settle their accounts and unethical acts before HMRC trace them. The Finance Act is a big step towards empowering DOTAS rules, which leads to the detection of tax avoidance at the initial stage, and its main focus is on promoters to govern corporations. As per the rules provided under DOTAS, a scheme is framed that covers promoters and corporations, which restricts companies and promoters from claiming relief for reflective monetary losses on the disposal of shares and relief on intellectual property. Due to these rules, companies are not able to make multi-layer investments through subsidiaries to avoid disclosure and reporting. The Act also imposed penalties on rogue operators as a safeguard for the waste management sector; these penalties restricted their ability to operate illegal landfill sites (Finance Act, 2018). On the other hand, for individuals in the UK, DOTAS (disclosure of tax avoidance schemes) are introduced by the government and contain various rules regarding the systematic disclosure of tax avoidance arrangements applied by individuals concerned with taxes on income, national insurance contributions, taxes on capital gains, etc. Beside this, it also provides clear views on the definition of promoter for dis-closable arrangements of tax avoidance to make an appropriate disclosure in this regard. Therefore, from the above discussion, it is clear that effective steps are taken by the government to minimise tax avoidance and evasion; however, there is improvement required to make these steps tax-friendly. Coursework help is available at the Assignment Desk.

Need to Consult Directly With Our Experts?

Contact UsConclusion

From the above report, it has been articulated that the tax gap is a major issue before the UK's government, and such a gap is the result of tax avoidance and tax evasion. Taxpayers, whether individuals or corporations, always try to reduce or minimise their tax amount payable and develop new ideas and ways to avoid tax avoidance and evasion. So the government should track these new ideas and ways and make changes in regulations to reduce the tax gap. HMRC's current steps are impressive, and it tries to frame potential steps while considering previous cases and circumstances.

More samples related to tax and VAT

References

Books and journals:

- Khwaja, M.S., and Iyer, I., 2014. Revenue potential, tax space, and tax gap: a comparative analysis. The World Bank.

- Braithwaite, V., 2017. Taxing democracy: Understanding tax avoidance and evasion. Routledge.

- Rogoff, K.S., 2017. The Curse of Cash: How Large-Denomination Bills Aid Crime and Tax Evasion and Constrain Monetary Policy. Princeton University Press.

Company

Company