PART A

Case study: Residential Mortgage

Client's interview

On the basis of the cited case situation, Frederick John and Margaret Anne wish to purchase their own home. From the assessment, it has been found that the client has $184 plus FHOG available. The purchase price of land and construction cost account for $240 K and 350-360K. Along with this, from the interview, it has been assessed that the client will further spend $60k on furbishing and gardening. Through interviews, it has also been found that such couples will undertake insurance policies to safeguard them against illness and accidents. In an interview, the couple presented that there is no such requirement in relation to making changes in their lifestyle.

Get an Extra 5% OFF On Your Order in Our App

Scan the QR code with your mobile to unlock an exclusive offer!

Download App Now Scan me

Scan meProposed loan strategies

- Diversification: by using a capped interest rate

- Taking loans from banks using the safety net

- Targeting low-cost flexible loans.

From the assessment, it has been identified that Frederick John and Margaret Anne are eligible to get grants from the state commission office (Apply for the First Home Owner Grant, 2018).

|

NOTES TO LENDER TEMPLATE \ Loan application for X & X Loan amount $466000 Latest date for approval ………/………/………… Date: 28th April 2018 Please find the loan attached application for the above clients. Reasons behind taking a loan The reason behind taking a loan from Frederick John and Margaret Anne is that they want to purchase their own house and settle into one area. Employment Frederick working with BHP Billiton on their mining projects. Margaret (qualified nurse): Working in a child care center on a permanent/part-time basis Joshua: Full-time employed Current income level Frederick (annual income): $115,000 Margaret Anne: Earns $29,000 annually Joshua: $75.00 Recommendations Good financial position (couple and their one child is earning, only one child is dependent) High employment stability High security in new investment Sincerely Borrower |

EVIDENCE ENCLOSED

|

|

Y |

N |

N/ A |

|

1. A fully completed AAMC Training Assessment Cover Sheet

|

Yes |

|

|

|

2. A fully completed AAMC Training Document Checklist (this page) Case Study - Loan Application Preparation (Task 1)

|

Yes |

|

|

|

3. File notes from first contact through to settlement in chronological order

|

Yes |

|

|

|

4. Authorised Credit Representative Credit Guide and Licensee Credit Guide

|

Yes |

|

|

|

5. Client Needs Review or Fact Find

|

Yes |

|

|

|

6. Privacy Statement and Consent form

|

Yes |

|

|

|

7. Combined Credit Quote and Proposal

|

Yes |

|

|

|

8. Product Comparison Report (at least three options)

|

Yes |

|

|

|

9. Preliminary Assessment

|

Yes |

|

|

|

10. Costing sheet for Fees and Charges

|

Yes |

|

|

|

11. Fully completed Lender Loan Application or Copy of Online lodgement

|

Yes |

|

|

|

12. Lender's loan Document Check List (Normally forms part of loan application) ☠☠☠Process Applications for Credit (Task 2)

|

Yes |

|

|

|

13. A completed serviceability calculator (refer to useful resources)

|

Yes |

|

|

|

14. Loan Comments/Lender Comments

|

Yes |

|

|

|

15. Evidence of Income (Pay slips, Employers Letter, PAYG Summaries) 16. Evidence of an Offer & Acceptance or a Contract of Sale or a Purchase contract

|

Yes |

|

|

|

17. Evidence of Council approved plans (House and Land, Off the Plan packages) Plus a Fixed Price Building Contract

|

Yes |

|

|

|

18. Evidence of savings/ equity and other loan commitments

|

Yes |

|

|

|

19. First Home Owners' Grant application (These can be downloaded from your Office of State Revenue)

|

Yes |

|

|

|

20. Anti Money Laundering/Counter Terrorism Financing ID requirements Note: 2 forms of identification is required for each applicant to the loan and a separate AML ID form is required for each applicant.

|

Yes |

|

|

|

21. Evidence of Valuation successfully completed

|

Yes |

|

|

|

22. A Compliance file checklist Completing Customer File (Task 3)

|

Yes |

|

|

|

23. Fully completed Settlement document pack (Refer to the Settlement

|

Yes |

|

|

|

24. Create a customer/referrer database (Task 4 A) You are required to prepare and submit your database on contacts made from this transaction by using your internal CRM or a suitable program i.e. Excel.

|

Yes |

|

|

PART B

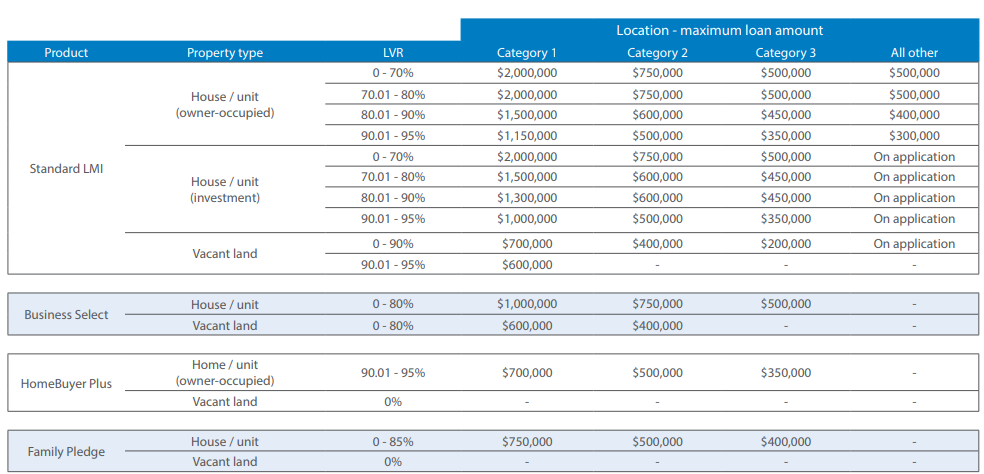

On the basis of Lender Mortgage Insurers guidelines following aspects need to be met for the purpose of loan approval. Below mentioned image shows that the loan volume ratio varies as per investment type. In the case mortgage case scenario, pertaining to vacant land, under the category of 90.1% to 95% loan ratio, the maximum amount implies $600000 respectively. On the other side, in the case of a 0-90% loan volume ratio, the maximum loan amount implies $700000, $400000 & $200000 respectively from categories 1 to 3. Hence, as per the guidelines provided by the lender mortgage insurer, depicted below, the loan application will be verified and then approved. Further, lender analysts need to ensure that the firm is following the aspects of responsible lending conduct obligations as per the National Consumer Credit Protection Act 2009 in checking, verifying, and maintaining records (Responsible lending, 2018).

(Source: Maximum LVR and Loan Amount Matrix. 2018)

PART C

Completion of a Customer File

- Customer contact sheet record

Customer: Frederick John and Margaret Anne

Banks: Commonwealth Bank (Big Four Bank home loan rate comparison, 2018)

Government bodies: The state commission office is offering $10000 to the couple as they are meeting eligibility criteria.

- Advice of loan approval: Being a finance broker, it is accountable to record and maintain the evidence of effectual communication done with customers, real estate, and settlement agents.

- Document Sign-Up/Settlement Preparation: In this, there is a need to ensure that the document is properly signed pertaining to the checklist and mortgage. Along with this, information regarding insurance and settlement checklist needs to be fulfilled by the finance broker.

- 4. Advice of Transaction Completed/Finalised: At this step, communication in relation to the successful settlement is done. Further, for finalizing the deal prominently there is a need to conduct a client satisfaction survey and thereby make necessary changes for improvement.

PART D

A

|

Date |

Database |

|

28/4 |

Approaching the customer |

|

29/4 |

Information Collection from customer |

|

30/4 |

Taking referrals from the client |

B

1. The database furnishes information about the extent to which the client is capable in relation to meeting obligations.

2. Professional relationship development is highly required for achieving success and enhancing brand image.

3. Individuals or customers with a history of credit defaults should not be contacted.

4. Interpersonal style or skills are highly required in the context of finance brokers. Moreover, without having effectual communication skills brokers would not become able to convince or deal with customers. Further, customer's requirements in relation to the loan policies and process also differ as per demographical aspects. Thus, the broker should keep in mind all such aspects while dealing with the clients.

5. Being a finance broker, it is highly required to take follow-up from the business referrers as it helps in checking or evaluating the credentials of the concerned customer.

6. For the development of new business focus will be placed on undertaking traditional and modern promotional aspects. In other words, by placing advertisements on social sites awareness among the customers can be developed regarding the services and thereby customer base as well as sales revenue.

REFERENCES

Apply for the First Home Owner Grant. 2018. [Online]. Available through: <https://www.sro.vic.gov.au/fhogapply>.

Big Four bank home loan rate comparison. 2018. [Online]. Available through: < https://www.finder.com.au/home-loans-with-the-big-four-banks>.

Maximum LVR and Loan Amount Matrix. 2018. [Online]. Available through: <https://www.genworth.com.au/media/1116/maximum-loan-amount-matrix-australia-mlama0217-v10.pdf >.

Responsible lending. 2018. [Online]. Available through: <http://asic.gov.au/regulatory-resources/credit/responsible-lending/>.

To get more details about assignment help, meet our experts.

Company

Company