This presentation is going to highlight the main role of fiscal and monetary policy in the UK as well as its impact on the economy. The business environment includes all internal and external information that affects the activities of a company, like economic policies.

Role of Fiscal Policy

Fiscal policy refers to a means by which the regulatory bodies of a nation regulate and adjust tax rates, spending levels, and more. The main purpose behind such adjustment is to monitor and manage the country's economy. In other words, fiscal policy can also be defined as the taxation level that influences the economic growth rate. According to the theory of economics, the government of a country influences the macroeconomic level of productivity either by increasing or decreasing public spending and tax levels. In turn, this will curb inflation, which is considered healthy if it lies between 2% and 3%. Moreover, this will also aid in increasing employment as well as maintaining a healthy value of money.

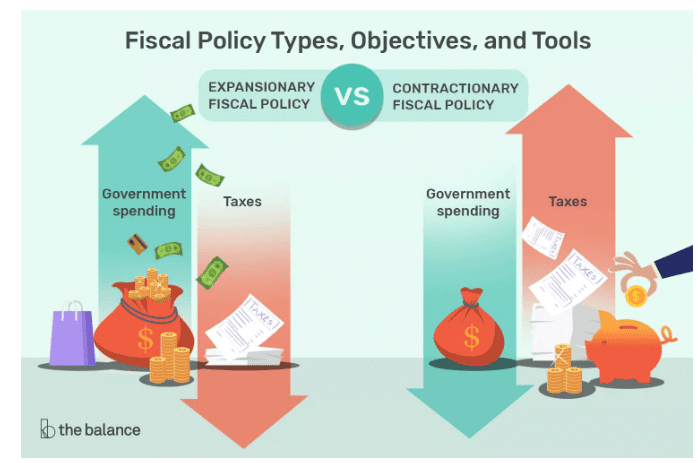

Fiscal Policy is generally found under two types that are- Expansionary and Deflationary.

- Expansionary fiscal policy: This policy is widely used as it stimulates aggregate demand and boosts the economic growth rate of the nation. It includes lower taxes, higher public spending, and more, all of which lead to government borrowing. Thus, this policy was mostly used during the recession.

- Deflationary fiscal policy: In contrast with expansionary, this policy is used to decrease aggregate demand and inflationary pressure. So, it involves higher taxes and lower spending, which in turn reduces government borrowing.

In context with the UK, this country is considered as one of the top developed nations due to stable economic conditions. Some major roles played by fiscal policy in the development of the economy are given below:-

Development of the Private Sector: In a developing country, the private sector plays an important role in improving the condition of the economy. The production and productivity of such sectors are majorly influenced by fiscal policies like taxation, public spending, and more. Tax relief and subsidy rebates are granted for boosting up operational activities of the private sector. Moreover, fiscal tools and measures are also used to activate the capital market to ensure the availability of proper resources in the private sector.

Optimization of Resource Allocation: Fiscal tools can also be utilized for effecting optimum resource allocation. As in private sectors, adequate resources are often directed towards production, which caters to the major requirements of the high and richer sections of society. Therefore, fiscal tools may be employed for the allocation of mobilized resources in desirable investment channels. This will turn resources into social lines of production from less useful production of private sectors. In this regard, the reallocation of resources can also be done through different incentive measures and subsidy programs.

Creation of Social and Economic Overhead: Proper basic infrastructure is a vital requirement for economic development. It includes the provision of social overheads such as health and education services, transport and telecommunication facilities, power generation, etc. It will help in enhancing the living standard and productivity of human beings as well as speed up the process of industrialization. Building and developing such infrastructure needs a lump sum amount of investment, which cannot be expected by the private sector. Therefore, governmental bodies have to arrange such investments. So, they acquired this through fiscal measures of expenditure programs and taxation.

You can also read How European Monetary Policy Affected their Recovery

Role of Monetary Policy

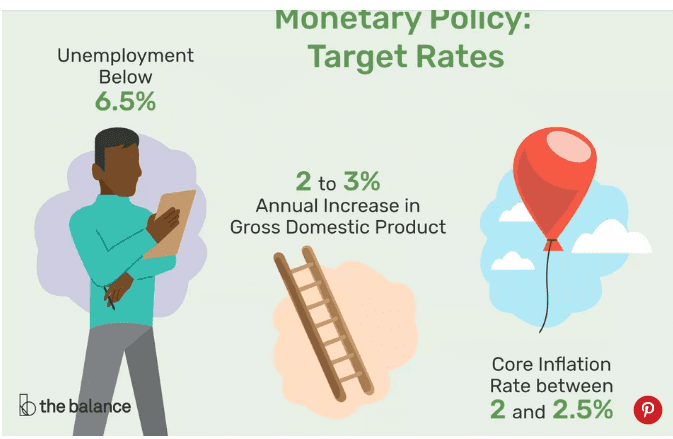

Monetary Policy shows how central banks monitor and manage liquidity for the creation of economic growth. The term liquidity shows the amount of money supply, which includes cash, credit, checks, and mutual funds. Along with all these terms, credit is an important concept that includes bonds, loans, and mortgages. For example, in the UK, the primary objectives of the central bank are to reduce the unemployment rate by at least 6.5% and manage inflation.

In the UK, central banks use three main monetary tools: open market operations, discount rates, and reserve requirements. When financial institutions want to buy or sell securities from banks of other countries that add or reduce cash to reserves, then it is termed an open market operation. Reserve requirement refers to keeping reserve at the central bank, where a low reserve requirement allows financial institutions to lend more for deposits. Similarly, the discount rate is the third tool that banks charge from their members to borrow. In economic development, the main roles of monetary policy are:

Adjustment between Demand and Supply for Money: The development of the economy tends to raise demand for money. The main reason behind this is that the corresponding contraction of a particular sector will increase transaction demand for money. Along with this, a rise in per capita income as well as an increase in population also demand the same for carrying out their day-to-day operations. Therefore, in this regard, monetary policy plays an important role in economic development. It minimizes fluctuation in prices and economic activities by creating a balance between the productive capacity of the economy and the demand for money.

Creation and expansion of financial institutions: Through the improvement of the currency and credit system of a nation, monetary policy can boost the process of economic development. For the attainment of this purpose, financial institutions and banks need to be established more. It will provide credit facilities and mobilize savings also. Thus, in this regard, monetary authorities help in the establishment and expansion of financial institutions in rural and urban areas. As these policies aid in monetizing the non-monetized sector as well as for capital formation, they encourage saving and investment.

Debt management is one of the main functions of monetary policy, which aims at stabilizing price rates, decreasing the cost of servicing public debt, and more. Along with this, the primary objective of debt management is to generate such conditions where the rate of borrowing money by the public can be increased per year.

Impact of Fiscal and Monetary Policies on the Economy and Business Activities of Organisations

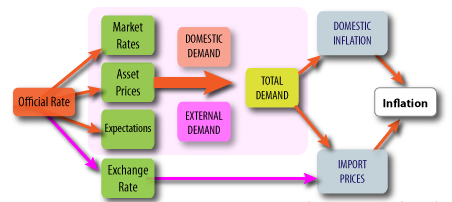

Monetary and fiscal policies refer to the most widely recognized tools used for influencing the economic activities of a nation. In this context, monetary policy is mostly concerned with the supply of money and the management of interest rates. Such functions are carried out by the Central Banks of a country. In the UK, central banks used monetary policies to check growth and stimulate the economy. Similarly, fiscal policies refer to a collective term for spending and taxation rates. These policies aim to target total spending and level of composition.

In pursuit of macroeconomic stabilization, both monetary and fiscal policies play a prominent role. According to Irwin (2013), they believe that monetary policies have a great impact on economic activities. As per the views of Jeston (2014), rather than monetary, fiscal policies influence much, as they play the main role in setting exchange and taxation rates. In the UK, monetary policies are set by the Monetary Policy Committee (MPC). They set base rates, which are also known as the rates commercial banks borrow from central banks. Therefore, changes in base rate in turn influence the overall interest rates of the economy. It includes savings rates mortgages and more. To determine whether inflation will rise or fall, MPC considers some main economic variables. It includes unemployment, the exchange rate index, house prices, spare capacity in the economy, etc. For example, with expectations of higher inflation and growth, members of MPC will tend to increase interest rates. While to fall inflationary rate, they have to decrease or cut interest rates.

As shown from this figure, the economy will face recession if the inflation rate falls below the target of the government, i.e. 2%. So, under this period, the Monetary Policy Committee is likely to cut interest rates. Thus, lower interest rates will make it cheaper to borrow, which encourages spending and investment as well. This will also lead to an increase in Aggregate Demand (AD) and growth rate, as shown in the mentioned figure. In addition to this, lower interest rates also give various advantages, like:

- Reduce incentives to save: Low interest rates give a smaller return from saving, which will encourage people to spend more.

- Cheaper borrowing costs: This will encourage borrowers to take loans from banks and financial institutions at low rates of interest.

- Lower mortgage interest payments: A fall in interest rates also reduces the cost of mortgage repayments, which will cause a rise in consumer spending.

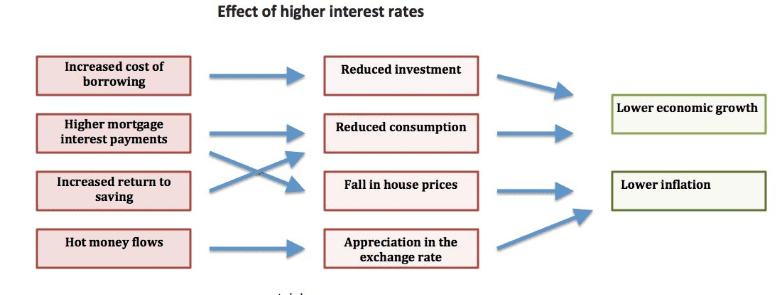

When the inflationary rate is predicted to rise more than the target, then the central bank increases interest rates. This will lead to increased cost of borrowing and reduce disposable income. So, it majorly affects growth in customer spending and reduces the rate of economic growth and inflationary pressure.

This figure depicts that higher interest rates will lead to:

- Increase Cost of Borrowing: With increased rates of interest, interest payments on loans, credit cards, etc. become more expensive. So, it will lead to discourage the public from spending and borrowing.

- Increase in mortgage interest payments: As the interest cost of borrowing is increased due to the high rate of interest, payments on mortgages also rise. Thus, this will significantly impact personal discretionary income as well and have a significant impact on public spending.

- Increase incentive to save rather than spend: Since interest rates become high, the public will be concerned about depositing their income in accounts. So, it will lead to a rise in economic conditions also.

- Higher interest rates increase the value of currency. If the currency rate of the UK becomes high, then it will reduce exports and increase imports. Thus, it will lead to reduced aggregate demand in the economy.

- Government debt interest payments increase: Currently, the UK pays more than £30 billion in a year on its national debt. Therefore, higher interest rates also lead to increased costs of interest payments. This in turn will increase high taxation in the future as well.

Impact of Fiscal and Monetary Policies on Organizations:

With a high rate of taxation, the government can easily pull money out of the economy, which slows down the business activities of organizations. Whereas for stimulating the economy, regulatory bodies use fiscal policies, which might offer tax rebates or lower taxes as well. Therefore, it has been seen that for improving the real economy, fiscal policy (expansionary) is more effective. While, in terms of the financial economy, the better choice will be monetary policy (expansionary). However, both types of policies create a large impact on organizations and individuals in many ways. It includes-

Business Cycles: Monetary and fiscal policies affect activities of business like the cycle of expansion, recovery, and recession. For example, when the growth rate of the economy is high, then business organizations provide employment. So, this shows the expansion phase of companies, where the spending rate of customers also increases. But at the peak point of the economy, the rate of interest to stave off inflation increases. This will result in a reduced sales profitability ratio, which will lead to the shutting down of businesses of small or private companies. It raises a high rate of unemployment also.

Impact of fiscal policies: It involves fluctuations in taxation rates and public spending policies where lower taxes show high disposable income for customers. It also refers to more cash for organizations to make investments in jobs and machinery. Stimulating spending programs, which involve improvement and development of infrastructure, drive business demand as it creates short-term jobs. While increasing the rate of income tax can decelerate as well.

Impact of monetary policy: Fluctuation in short-term interest rates mostly influences long-term rates. For example, low interest rates show fewer expenses for organizations but higher disposable income for customers. So, this will lead to more profitability for business. Moreover, lower rates of mortgages may stimulate the buying power of customers, which also drives profitability in businesses. In contrast, high interest rates impact an opposite manner on organizations operating in a country. It includes lower sales and profitability, high-interest expenses, and more.

We have a sample of financial management also.

Thus, it has been concluded from this discussion that for the business environment, inflation refers to higher costs. Unemployment shows a decline in sales and profitability because, during inflation, mismatches occur between the abilities required for a particular job and the skills of unemployed workers. Therefore, in this context, monetary policies control inflationary periods, and fiscal tools measure the demand for retraining unemployed laborers. It helps in bringing the level of unemployment down over the long term.

Conclusion

From this presentation, it has been concluded that both monetary and fiscal policies help in improving and developing the economy of a country. Any changes in such policies will affect not only the economy but also organizations that run their businesses over there and public spending as well.

Get assignment help from our experts!

References

Books and Journal

- Irwin, A., 2013.Sociology and the environment: a critical introduction to society, nature and knowledge. John Wiley & Sons.

- Jeston, J., 2014. Business process management. Routledge.

- Yu, W., and Ramanathan, R. (2012). Effects of business environment on international retail operations: case study evidence from China. International Journal of Retail & Distribution Management. 40(3). pp. 218-234.

Company

Company