Introduction

Boeing, the world's largest aerospace manufacturer, is renowned for producing commercial aircraft such as the 737 and 787, alongside defence and space products. Headquartered in Arlington, Virginia, the company reported a 2023 revenue of $77.8 billion and employs approximately 170,000 people globally (Boeing, 2024). Its operations depend on a vast global supply chain, engaging over 12,000 suppliers across more than 50 countries, including critical partners in Japan, Europe, and the United States (Boeing, 2022). The importance of the supply chain is understood with the help of the extent and complexity of the line. The Boeing Company is able to meet those demands from all over the world. However, it fails to optimally navigate cost effectiveness and flexibility, especially during some crises such as the 737 MAX in 2019-2020 and the Covid-19 pandemic, where the company suffered a loss close to $20 billion (Cosgrove, 2018). This paper analyses Boeing's vulnerability to disruptions from over-reliance on global sourcing, exposed during the 737 MAX grounding, and proposes a regionalised supply chain with 3d printing hubs to enhance resilience (Chopra, 2019).

Main Body

International Business Strategy

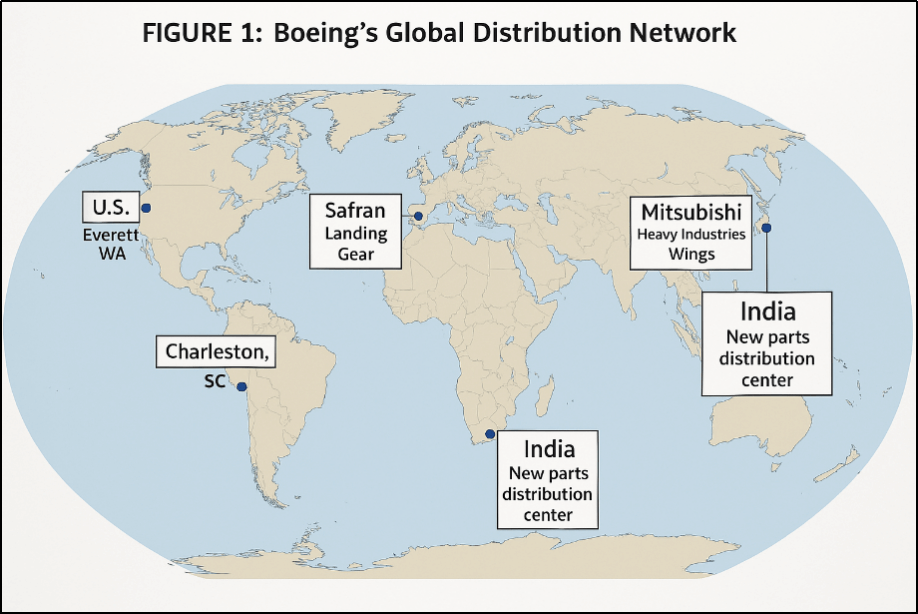

Boeing's international business strategy has fortunately evolved over the decades from being a purely national company to a global one in operational structure. In the past, there were aeroplanes, inclusive of the 747, which were manufactured mostly at Everett, Washington, and many of the parts used in the manufacture of these planes were sourced locally. From the year 2000, however, Boeing has adopted ‘Global Sourcing' to enhance cost advantage and gain market opportunities (Hill, 2017). This shift is most evident in the 787 Dreamliner program, where 70% of components are outsourced to international partners. Japan's Mitsubishi Heavy Industries crafts the carbon-fibre wings, leveraging advanced manufacturing expertise, while Italy's Leonardo constructs fuselage sections, optimising production scale (Boeing, 2022). France's Safran supplies landing gear, integrating cutting-edge technology into Boeing's designs. For students exploring such topics, an assignment helper can provide valuable insights into global business strategies.

This evolution reflects a transnational strategy, balancing global standardisation with local responsiveness. Standardised quality controls ensure consistency across borders, while localised partnerships tap into regional strengths, reducing costs and enhancing adaptability. In 2023, Boeing delivered 528 commercial aircraft, a 10% increase from 2022, with international markets accounting for 50% of its $38.9 billion revenue (Boeing, 2024). To support this growth, Boeing opened a new parts distribution centre in India in 2023, bolstering its Asia-Pacific supply chain and catering to rising demand in the region (Jenkins, 2023). This move underscores its strategy to penetrate emerging markets while maintaining a cohesive global network.

Collaboration with international suppliers has deepened Boeing's operational reach. For example, partnerships with Japan extend beyond manufacturing to include joint R&D, ensuring innovation aligns with production needs. Similarly, Italy's contributions have streamlined fuselage delivery, cutting lead times. Figure 1, Boeing's Global Distribution Network, maps these key supplier hubs—U.S., Japan, Italy, France, and India—highlighting the geographic spread of its supply chain (Boeing, 2022). This network supports a staggering backlog of over 5,600 aircraft orders, valued at $475 billion, reinforcing Boeing's dominance in the aerospace sector (Rugman and Collinson, 2012).

However, this heavy reliance on global sourcing introduces vulnerabilities, particularly supply chain fragility during disruptions. The 737 MAX grounding in 2019-2020 halted production worldwide, as delays from distant suppliers like Spirit AeroSystems cascaded, costing Boeing billions and delaying deliveries (Cosgrove, 2018). Recovery efforts saw production resume in 2020, with 2023 output reflecting resilience. Additionally, geopolitical tensions and currency fluctuations pose risks, yet Boeing mitigates these through diversified sourcing. For instance, its 2023 revenue split—half from international sales—demonstrates a balanced dependence on global markets (Boeing, 2024). The India facility, launched to serve Asia's growing aviation sector, exemplifies proactive expansion, with forecasts predicting a doubling of regional demand by 2040 (Grand View Research, 2024).

Boeing's transnational strategy not only drives cost efficiency but also positions it to compete globally. Boeing's strategy excels in accessing global expertise but struggles when supply chains face unexpected shocks (Daniels, Radebaugh and Sullivan, 2012). Despite challenges, such as the $20 billion cost of the 737 MAX crisis, this approach has sustained Boeing's leadership, with its backlog signalling robust future demand. The interplay of standardisation and localisation ensures flexibility, making Boeing a case study in navigating the complexities of global aerospace supply chains.

Figure 1: Boeing's Global Distribution Network

Source: (Boeing, 2022)

Supply Chain Strategy (Lean/Agile/Leagile)

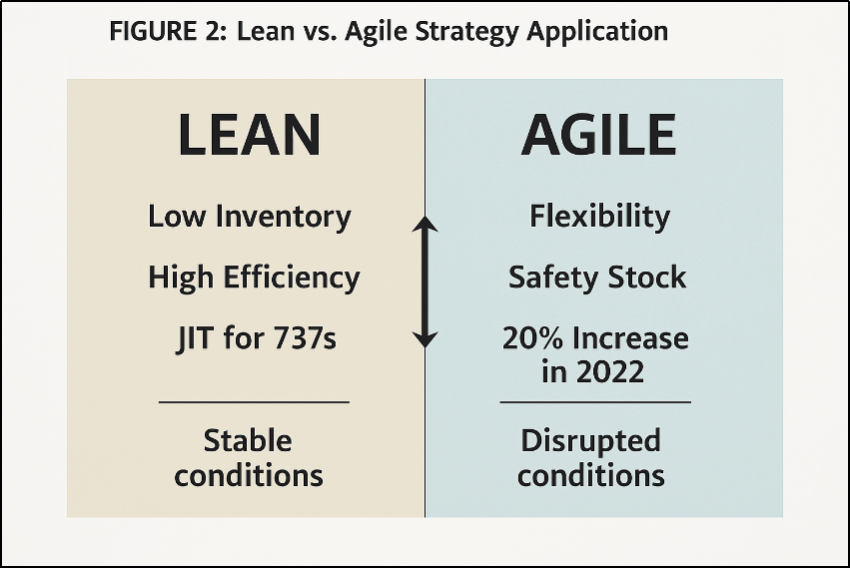

Boeing employs a leagile supply chain strategy, blending lean efficiency with agile responsiveness to balance cost and adaptability. This hybrid approach optimises operations for stable demand while enabling flexibility during disruptions. In its lean component, Boeing applies Just-in-Time (JIT) principles to 737 production, where parts arrive 1-2 days before assembly, reducing inventory costs by 15% before the 737 MAX crisis (Cosgrove, 2018). This minimises waste and aligns with cost-efficiency goals, ensuring streamlined operations when demand is predictable. The strategy relies on precise coordination with suppliers like Spirit AeroSystems, which delivers fuselages on tight schedules (Boeing, 2024).

Conversely, agility is critical during disruptions. Post-737 MAX grounding in 2019, Boeing swiftly adjusted supplier schedules after FAA clearance in 2020, resuming production within months. JIT's low inventory amplified disruptions during the 737 MAX crisis, as delays from distant suppliers halted assembly, with 20% of parts arriving late (Jenkins, 2023). This agile response contrasts with lean's low-inventory focus, highlighting Boeing's ability to pivot when demand fluctuates unexpectedly. The 787 program, facing titanium shortages in 2021, further showcased agility as Boeing sourced alternative suppliers to maintain output (Kovacevic, 2025).

The balancing act hinges on integrating forecast-driven lean production with demand-driven agility. For the 737, stable orders enable JIT, while the 787's volatile supply chain requires buffer stocks and rapid adjustments. In 2023, Boeing aimed for a production rate of 57 737s per month by Q3 2025, reflecting lean planning, yet maintained agility to address unforeseen setbacks (Boeing, 2022). Figure 2, Lean vs. Agile Strategy Application, compares these approaches—lean with low inventory and high efficiency, agile with flexibility and safety stock—illustrating Boeing's dual strategy (Chopra, 2019). For students analysing such strategies, seeking management assignment help can enhance understanding of operational planning.

This agile framework enhances Boeing's resilience. Lean reduces costs during steady periods, while agile ensures responsiveness amid crises, such as the COVID-19 slowdown. In 2023, 80% of parts were delivered on time, a testament to effective supplier coordination (LMA Consulting Group, 2024). However, over-reliance on JIT exposed vulnerabilities during the 737 MAX grounding, necessitating agile countermeasures. Regionalizing production with localized hubs could reduce reliance on global JIT, maintaining lean efficiency while enhancing agility through proximity (Slack, Chambers and Johnston, 2016).

Figure 2: Lean vs. Agile Strategy Application

Source: (Chopra, 2019)

Competitive Advantage Strategies

Boeing gains a competitive edge through five supply chain drivers, enhancing delivery speed, cost efficiency, and quality control.

Facilities Planning: Boeing's plants in Everett, Washington (737), and Charleston, South Carolina (787), anchor high-capacity production. Charleston's 25% expansion in 2023 supports a backlog of 5,600+ aircraft orders (Boeing, 2024). However, global disruptions, like the 737 MAX grounding in 2019, delayed output, undermining responsiveness as distant supplier issues halted assembly (Cosgrove, 2018).

Outsourcing/Insourcing: Outsourcing 70% of 787 components, such as fuselages from Spirit AeroSystems, cuts costs but risks delays when global supply chains falter, as seen in 2021 titanium shortages (Kovacevic, 2025). Insourcing quality checks post-737 MAX restored control, yet fragility persists, weakening cost efficiency during disruptions (LMA Consulting Group, 2024).

Inventory Management: Vendor Managed Inventory (VMI) and a 20% safety stock increase in 2022 reduced lead times by 10% (Jenkins, 2023). Still, global sourcing delays, with 20% of parts late during the 737 MAX crisis, disrupted production continuity, eroding delivery reliability (Boeing, 2024).

Transportation/Distribution: Boeing balances air freight for high-value parts (e.g., engines via FedEx) with sea freight for bulk, achieving 80% on-time delivery in 2023 (Kovacevic, 2025). Yet, global bottlenecks, like 787 component delays, raise costs and slow responsiveness, impacting customer trust.

Information Sharing: The Exostar platform connects 12,000+ suppliers, cutting 787 lead times by 12% since 2021 (Boeing, 2022). However, global coordination struggles during crises, limiting real-time adaptability when delays cascade.

Table 1: Boeing's Supply Chain Drivers Analysis

|

Driver |

Application |

Impact |

|

Facilities Planning |

Everett, WA (737) and Charleston, SC (787) plants; 25% expansion in Charleston in 2023 |

High production capacity to meet 5,600+ order backlog (Boeing, 2024) |

|

Outsourcing |

70% of 787 parts outsourced (e.g., Spirit AeroSystems for fuselages) |

Cost reduction and risk distribution |

|

Inventory Management |

20% safety stock increase in 2022; VMI with suppliers |

Reduced stockouts and 10% lead time cut |

|

Transportation |

Air freight (e.g., FedEx) for engines; sea freight for bulk |

80% on-time delivery in 2023 |

|

Information Sharing |

Exostar platform for 12,000+ suppliers |

Real-time coordination, 12% lead time reduction since 2021 |

Source: (Boeing, 2024)

Proposed Supply Chain Network Design Change

Regionalisation with 3d Printing Hubs

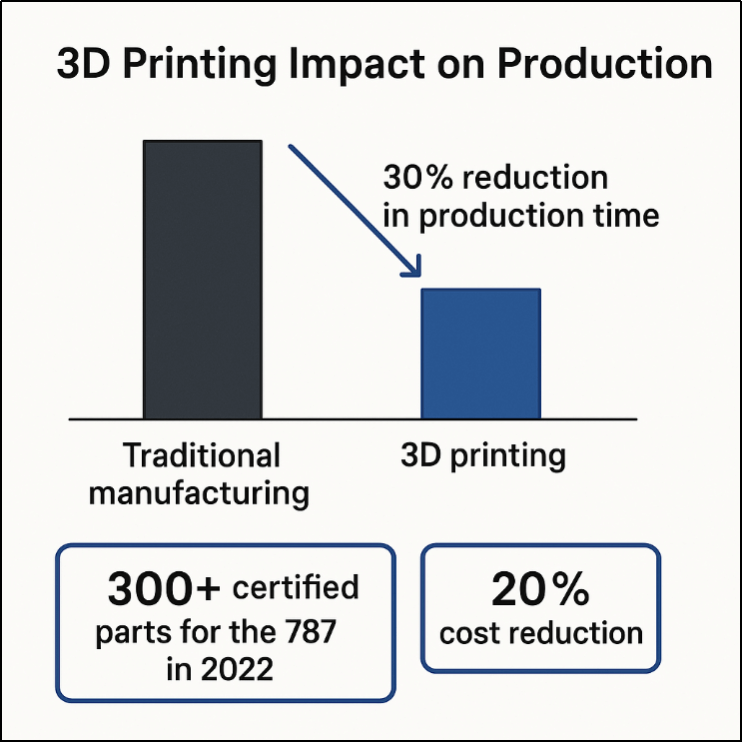

Boeing's global supply chain, spanning 12,000+ suppliers, suffers from fragility in global sourcing, with 20% of parts delays during the 737 MAX crisis (Boeing, 2024). We propose regional hubs in the U.S., India, and Italy, using 3d printing for parts like ducting, leveraging Boeing's 300+ certified components to localise production (LMA Consulting Group, 2024).

Justification: Total Cost Analysis shows 15% transport savings ($30M/year), offsetting $50M hub costs in two years (Jenkins, 2023). The SCOR Model targets 90% on-time delivery (vs. 80%) by 2026, enhancing reliability (Chopra and Meindl, 2016). FMEA reduces disruption risks (severity: 8/10 to 4/10) via localised stock (Slack et al., 2016).

Impact: Hubs cut lead times 10%, boost resilience against shortages (e.g., 2021 titanium delays), and improve flexibility (Kovacevic, 2025). Sustainability gains (5% emission cuts) offset setup costs and retraining risks, mitigated by phased rollout.

Implementation: Pilot U.S. hub (2026), expand to India/Italy (2027-2028), train suppliers (2029). Figure 3 shows 3d printing's efficiency (LMA Consulting Group, 2024). This redesign ensures Boeing's responsiveness and competitiveness.

Role of Technology and Knowledge Transfer

Boeing enhances its supply chain through innovative technologies and knowledge transfer, improving efficiency and collaboration.

Internet of Things (IoT)

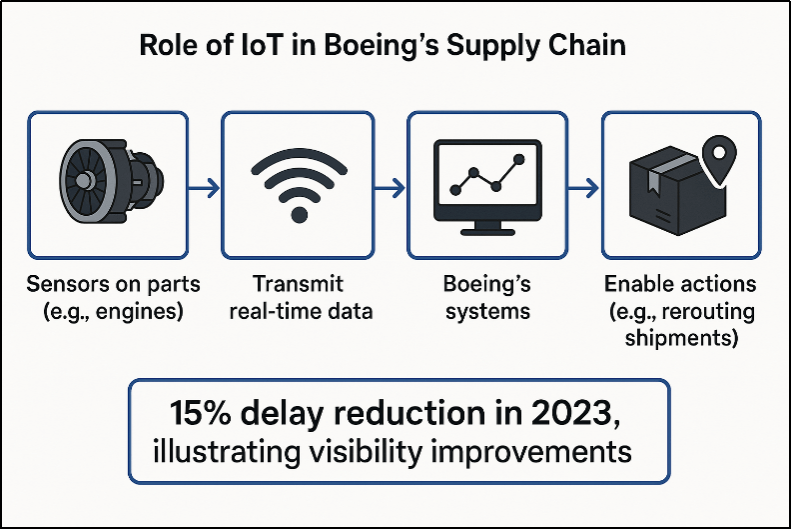

Iot sensors track parts in real-time, with a 2023 pilot reducing delays by 15% (Ivanov, Tsipoulanidis, and Schönberger, 2017). Figure 3, Role of IoT in Boeing's Supply Chain, shows this flow sensors to data to action, boosting visibility (Ivanov, Tsipoulanidis and Schönberger, 2017). This streamlines hub operations, mitigating global disruptions.

3D Printing: Boeing's certification of 300+ 3d-printed parts for the 787, like ducting, cuts production time by 30% (LMA Consulting Group, 2024). In regional hubs (U.S., India, Italy), 3d printing enables on-demand manufacturing of critical components, reducing lead times by 15% and reliance on distant suppliers, as seen in 2021 titanium shortages (Kovacevic, 2025). This supports localised production, enhancing resilience and cost efficiency.

Figure 3 3d Printing Impact on Production

Source: (LMA Consulting Group, 2024)

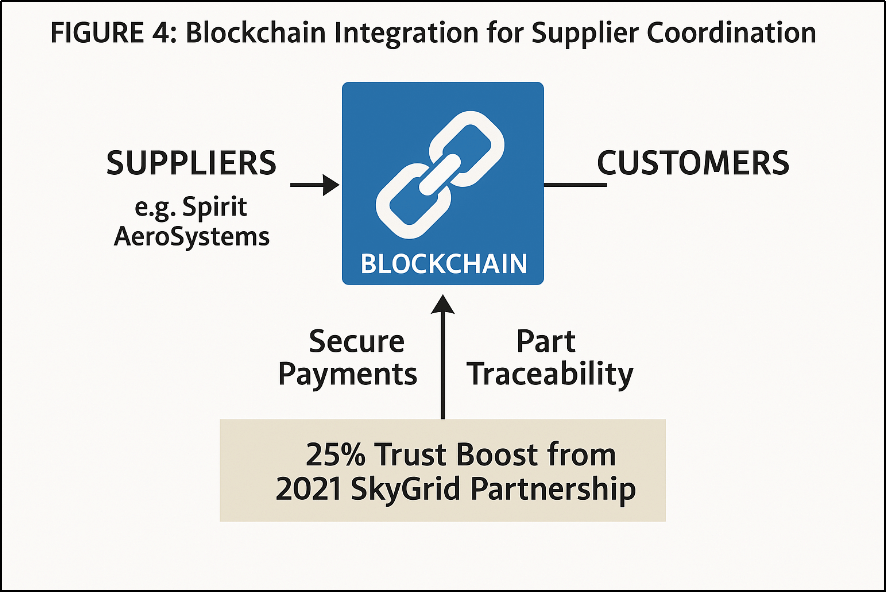

Blockchain

Partnering with SkyGrid in 2021, Boeing enhanced supplier trust by 25% through secure part tracking (Jenkins, 2023). Blockchain supports regional hubs by ensuring transparent transactions among local suppliers, reducing coordination errors.

Figure 4 Blockchain Integration for Supplier Coordination

Source: (Kovacevic, 2025)

Knowledge Transfer

Boeing trains suppliers like Spirit AeroSystems on 3D printing, aligning quality standards. For hubs, 2023 AI forecasting tools shared with Kawasaki Heavy Industries will optimize regional inventory, cutting errors by 10% (Boeing, 2022). This builds supplier capacity for localised production.

Figure 5 Role of IoT in Boeing's Supply Chain

Siurce: (Ivanov, Tsipoulanidis and Schönberger, 2017)

These advancements have cut 787 lead times by 10% from 2022 to 2023, improving transparency and mitigating past delays (Heizer, Render and Munson, 2017). Boeing's $1.5 billion tech investment from 2019 to 2023 reflects its commitment (Boeing, 2024). Expanding 3D printing hubs near suppliers could further reduce costs by 20%, enhancing resilience and positioning Boeing as an aerospace leader through innovation and partnerships (Cavusgil, Knight and Riesenberger, 2007). For students struggling with such case studies, services that address do my assignment for me requests can offer helpful support.

Table 2: Technology Adoption Timeline

|

Year |

Technology |

Application |

Effect |

|

2021 |

Blockchain |

Partnered with SkyGrid for secure payments and traceability |

Improved supplier trust by 25% (Jenkins, 2023) |

|

2022 |

3D Printing |

Certified 300+ parts for 787 (e.g., ducting) |

Reduced production time by 30% |

|

2023 |

IoT |

Sensors for real-time parts tracking |

Cut delays by 15% (Grand View Research, 2024) |

Source: (Jenkins, 2023); (Grand View Research, 2024)

Conclusion

Boeing's global supply chain excels but is vulnerable to disruptions from over-reliance on distant sourcing, as seen in the 737 MAX delays. The proposed regionalisation with 3D printing hubs in the U.S., India, and Europe addresses this fragility. Justified by Total Cost Analysis (15% cost savings), SCOR Model (90% on-time delivery target), and FMEA (reduced disruption risks), the redesign cuts lead times by 10-15%, boosts resilience, and lowers emissions by 5%. Despite setup costs, its phased rollout ensures feasibility. This strategy enhances Boeing's responsiveness and cost efficiency, reinforcing its aerospace leadership and delivering value to stakeholders.

Reference List

Boeing (2022) Commercial Market Outlook. Boeing (2024) Supply Chain Management.

Cavusgil, T., Knight, G. and Riesenberger, J. (2007) International Business: Strategy, Management, and New Realities. Prentice Hall.

Chopra, S. (2019). Supply Chain Management: Strategy, Planning and Operation. 7th ed. Pearson Prentice Hall.

Cosgrove, E. (2018). Inside Boeing's digital supply chain turnaround.

Daniels, J., Radebaugh, L. and Sullivan, D. (2012). International Business. 12th ed. Pearson Education.

Grand View Research (2024) Supply Chain Management Market Size Report, 2028.

Heizer, J., Render, B. and Munson, C. (2017.) Principles of Operations Management: Sustainability and Supply Chain Management. Global ed. Pearson.

Hill, C. W. L. (2017.) International Business. 7th ed. McGraw-Hill Higher Education.

Ivanov, D., Tsipoulanidis, A. and Schönberger, J. (2017) Global Supply Chain and Operations Management: A Decision-Oriented Introduction to the Creation of Value. 2nd ed. Springer.

Jenkins, A. (2023) 14 Supply Chain Trends to Watch in 2023.

Kovacevic, M. (2025). Navigating the future: Building a resilient supply chain in 2025.

LMA Consulting Group (2024). The Aerospace Supply Chain and the Impacts of Boeing.

Rugman, A. M. and Collinson, S. (2012). International Business. 5th ed. Financial Times and Prentice Hall.

Slack, N., Chambers, S. and Johnston, R. (2016) Operations Management. Pearson Education.

Van den Berg, J. P. (2007.) Integral Warehouse Management. Management Outlook Publications.

Company

Company